Majority of the people worldwide are often faced with financial problems which lead to financial stress. Financial stress can be from being in debt, not earning enough money, the expense of raising kids or even being married to someone who isn’t good with money. Power, a fintech startup based in Kenya has created a platform which is enabling gig and salaried workers to easily access earned wages, loans, insurance, and payments and contribute to savings via partner banks to reduce financial stress in Kenya. Reducing your financial worry can enable you focus on other important areas of your life and relax as you already have a plan that handles your financial situation.

The startup seeks to alleviate the finance stress situation by working with regulated financial service providers to provide Kenyans and eventually workers across Eastern and Southern Africa with a holistic, financial wellness solution. The offering entails of four key elements that enables users to protect themselves against financial shocks via tailored and affordable insurance products. Kenyans can pay for everyday expenses such as electricity, airtime and groceries via early access to already earned wages. Saving through a secure interest bearing savings account should no longer be a worry as Power provides the safest and accessible platform. Based on the digital financial profiles clients build using the app, the more they are provided with a borrowing platform.

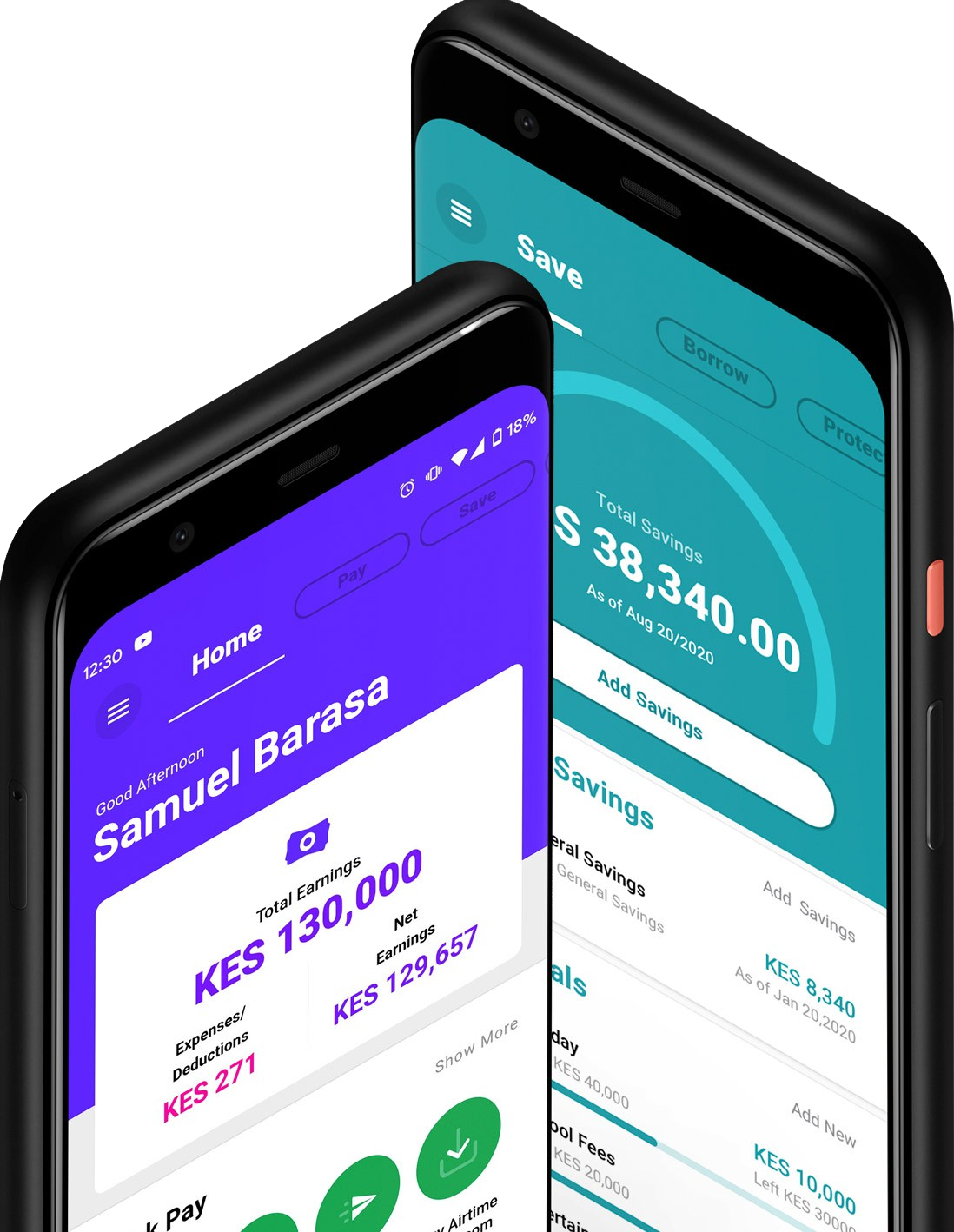

Power provides the power to pay platform which enables clients to seamlessly manage all their expenses as Power slowly recovers from the clients’ future earnings. In this Platform, customers can buy airtime, pay bills, send money, shop online and buy goods. The cash flow of the clients is managed as Power provides the tools to cash out or spend as you earn within your limits.

The power saving platform is safe and secure as well as it is licensed and operated by regulated banking institutions in Kenya. Customers can put in a goal and allocate a percent of their income or schedule deposits from their debit card, bank account or mobile money. Managing cash flow and saving even small amounts can enable one to live a financially responsible life. Despite the amount one has, Power encourages saving as this can add up over time to help secure one against those unexpected moments in life.

The Power to borrow platform enables the salaried workers with long term loans which are deducted from their future income. Through this platform, clients create a good credit profile which enables more borrowing. The Power platform is created to move low income workers to a more enhanced financial ground.

The startup connects workers to affordable, tailored insurance products for customers as well as their families and dependents. Depending on the nature of work and the needs of the users, Power offers insurance products which cover a range of risks .Risks from basic health cover to maternity, accident and funeral cover, to vehicle and property insurance are catered for. Financial management should no longer be a worry as Power provides full assistance.