Capitec ,a South Africa-based digital bank has partnered with Ozow ,a digital payments gateway to launch a new payment solution aimed at revolutionising the banking sector in South Africa.

The partnership seeks to build an innovative ecosystem for payments and establish greater financial inclusion in the country.

Thomas Pays, CEO of Ozow, stated that cybersecurity has always been a top priority for the company, cybercriminals are becoming more sophisticated, and there is an onus on banks and fintechs to collaborate on the building of secure, efficient, and reliable means of transacting for the consumer. We can see the impact this kind of innovation is having in global markets. It has the potential to improve economic growth, and my team will continue to engage with all banks to support them in adopting open APIs for better third party payment provider (TPPP) and fintech integration.

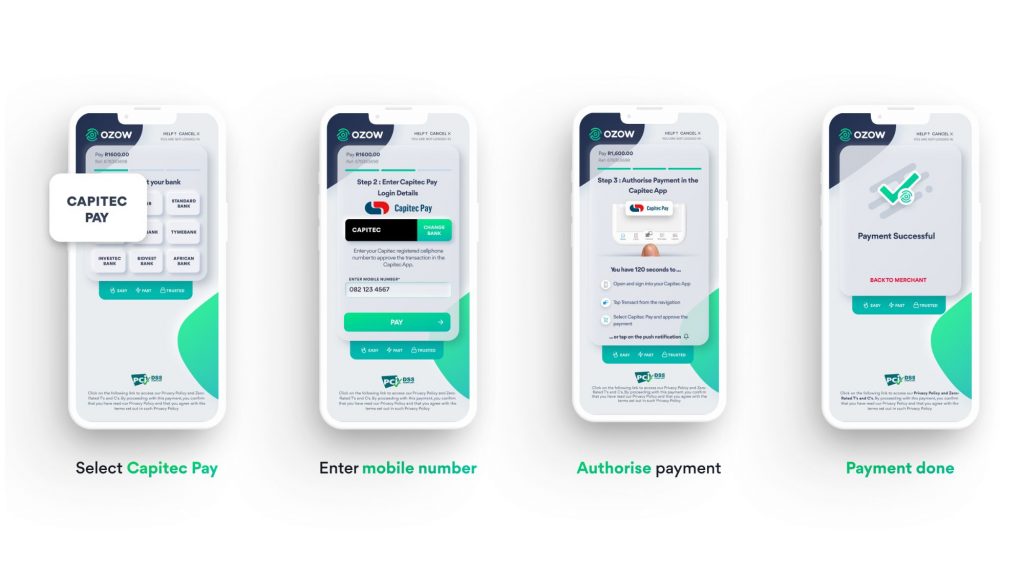

As part of the agreement ,Capitec Pay will be integrated into Ozow’s Pay by Bank offering, a simple, secure, and easy payment solution that allows customers to pay directly from their bank to the merchant without the need to use a bank or credit card.

With API integration of Capitec Pay, Ozow is positioning itself as a leader with regards to advocating for open APIs with banks in South Africa.

The Pay by Bank, funds will be transferred directly from the customer’s personal bank account to the merchant account as soon as the authentication of a transaction is complete. This significantly reduces payment operations costs, the incidence of fraud, and processing times.

The Capitec Pay system allows clients to identify themselves with their mobile phone number or ID number, rather than the username and password combination that has been the primary method for users to access their bank accounts.

The final payment is approved in a pop-up confirmation message in the app, providing added security to customers. Consumers can also revoke consent and opt out at will, at any time.

Jerome Passmore, head of Capitec Pay, believes that the Ozow-Capitec partnership is poised to revolutionize the way South Africans transact and engage with their finances. According to him, using Capitec Pay allows clients to feel safe shopping online by simply approving transactions within the Capitec banking app.

“Apart from providing our banking clients with peace of mind that their bank account information will be protected, the convenience of using Capitec Pay provides a quick, easy checkout, and seamless payment experience,” he added.

The partnership between Ozow and Capitec offers a more secure, accessible payment option for customers and demonstrates a commitment to democratising Africa’s emerging neobank landscape. Pays encourages other banking institutions to join the digital revolution and embrace the future of payments.