FairMoney, a digital bank in Nigeria, has announced the launch of an improved version of its mobile banking app home page.

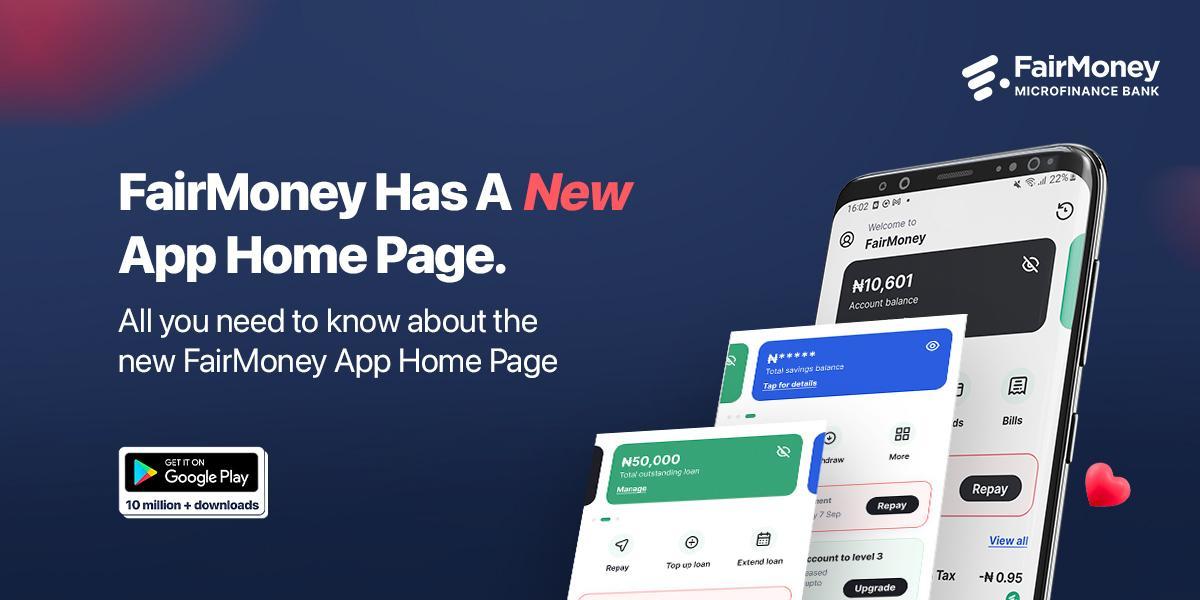

The revamped app, which has a refined and contemporary look will give users a better experience while enhancing seamless transactions.The updated app has a new home page interface that brings all essential features and services to the forefront, making navigation even easier for users.

Among the most notable changes is the inclusion of a top banner that displays users’ account balance, outstanding loan balance, and savings all at a glance.

Speaking on the FairMoney app refresh, Head Marketing and Branding, FairMoney, Nengi Akinola stated,“Our revamped mobile banking app is a result of our commitment to providing seamless banking to our customers. We have focused on making banking as seamless and easy as possible for our users, while offering even more value through enhanced functionality.

“The revamped FairMoney app is a game-changer in digital banking, offering users more value, more convenience, and more control over their finances. We are excited to roll out the new and improved app and look forward to continuing to innovate and evolve our digital banking services.”

The app redesign also includes the rearrangement of some functions on the home page, improved functionality, such as balance cards and quick actions, better navigation and more organized services arrangement on the app.

For existing loan users, the new loan homepage displays current loan details and options to extend or top up loans all at a glance, while the savings homepage puts users’ savings plan at the bottom right corner of the screen. Other new features include an information bar to keep users informed of discounts and deals, service shortcuts that make transferring money, funding accounts, requesting ATM cards, and paying bills as easy as tapping a button.

FairMoney wants to become the leading financial partner serving underserved consumers in large emerging markets.It offers a range of digital financial products including, near-instant digital loans 24/7, investment products, savings, payments, and cards directly via its mobile app.

The digital lending product offering covers loans in tenor from 15-days to 24 months to MSMEs and consumers. The end-to-end application to loan offer process takes 5 minutes and is fully digital with no physical touchpoints. The company aspires for its over 6 million digital bank users to have a wholesome banking experience from P2P transfers and lending to debit cards, current accounts, investment products amongst other products.

The updated FairMoney app is available for download on the Google Play Store.