In the sprawling ports of Lagos, Timothy Joseph, a finance manager, stares at a screen refreshing a payment status that refuses to change. Somewhere between two continents, the money exists, but a broken infrastructure leaves Joseph unsure of his payment status. In Africa’s cross-border trade, this scenario is a familiar presence where funds are caught in opaque systems, nameless intermediaries, and processes no one fully controls.

Against this backdrop, Rojifi is launching to fix the trust and delay problem with business payments in Africa. More than a pan-African startup, it’s a bet to prove Africa’s traders deserve systems that see them, name them, and move at the speed their businesses demand.

In 2025, Africa was a key driver of global trade gains alongside East Asia and South-South trade, with its imports growing faster than any other region. Exports also performed strongly, tied with Asia for the fastest growth rate in merchandise exports.

The World Trade Organization (WTO) and the UN suggest that while Africa experienced strong import and export growth in 2025. Projections for 2026 indicate a moderation in global and African trade growth due to factors such as global economic slowing, trade policy uncertainty, and rising debt.

Despite the trade slowdown, Africa is expected to be the world’s fastest-growing economic region in 2026, with GDP growth projected to reach 4.0 percent in 2026 and 4.1 percent in 2027, according to the UN and the African Export-Import Bank

Yet, for modern African business, the hardest part of global trade isn’t navigating customs or finding a buyer; it is the act of paying. It is the moment when money becomes the bottleneck.

A System Designed for a Different Era

The African Development Bank (AfDB) estimate highlights how settlement delays and high foreign exchange (FX) charges can erode up to 15 percent of African small and medium enterprises’ (SMEs) operating margins, making these factors critical to business survival and growth, particularly for firms with already razor-thin margins like pharmaceutical distributors.

These challenges lead to significant cash flow problems, increased borrowing costs, and strained supplier relationships.

“Global commerce has become real-time, but African payments infrastructure hasn’t,” said Moses Onyekaonwu, founder and CEO of Rojifi. “You can have the capital, the demand, and the supplier, but without the ability to move money instantly and credibly, the entire system breaks down.”

From Friction to Foundation: The Founder’s Journey

Before launching Rojifi, Onyekaonwu managed multiple businesses with complex supply chains reaching across Asia.Hence, Rojifi did not emerge from a whiteboard at a venture capital firm; it was born from the ‘lived friction’ of a founder who had been faced with a similar issue.

He knew the feeling of watching a critical order get cancelled because a payment was ‘held for review’ by a distant intermediary bank. He knew the strain of explaining to a Chinese supplier why a payment appeared to come from an unknown third-party broker rather than his own company.

“In Africa, you could have the money, but not the ability to move it instantly,” Onyekaonwu reflects. “And the longer you wait, the more you lose.”

This frustration shaped Rojifi’s central thesis, which is that African businesses deserve to pay international suppliers directly, transparently, and crucially in their own name. This implies that no offshore entities, informal brokers, or workarounds that erode credibility.

The Anatomy of Trust: Why ‘In-Name’ Payments Matter

In the world of global finance, there is an invisible barrier more formidable than any tariff, which is regarded as ‘The Trust Deficit’.

When an African business sends a payment through traditional fragmented channels, it often passes through multiple ‘correspondent’ banks.

When the money reaches the supplier, the sender’s identity is often obscured or replaced by an intermediary’s name. This triggers ‘de-risking’, which is regarded as a process where international banks pull back from regions they perceive as opaque or high-risk.

Rojifi tackles this head-on. Every transaction on the platform is sent in the client’s registered business name and is clearly reflected on the MT103 SWIFT message.

“Your supplier sees your company name and not an unknown intermediary, and that credibility changes the relationship,” Onyekaonwu explains. This shift implies fewer disputes, faster audits, and the ability for African firms to build long-term, high-trust partnerships with global giants.

Built at the Intersection of Speed and Discipline

Rojifi positions itself at a unique crossroads: the agility of a fintech and the discipline of a traditional bank. This balance is perhaps most expressed in its ability to settle payments using stablecoins, which are digital currencies pegged to the US Dollars. Traders can move money across borders through stablecoins, which are then settled into foreign bank accounts.

A September 2025 J.P. Morgan report, titled ‘2025 Cross-Border Payments Trends for Financial Institutions’, cited a survey where 88 percent of respondents reported being a victim of payment fraud in 2022–2023. The report used this statistic to emphasise the challenge of cybertheft and fraud in cross-border payments.

To combat this, Rojifi uses AI-driven systems for:

- Behavioral Analytics: Reducing “false positives” that often flag legitimate African transactions as suspicious.

- Transaction Monitoring: Providing real-time oversight to ensure compliance without the traditional 36-hour wait.

- Streamlined Onboarding: Reducing the time to get trade-ready to as little as 24 hours.

Caleb Nnamani, expert African storyteller and Chief Executive at Blacktrigger, said, “An ever-increasing demand for imported goods on the continent has carved out global payments for African businesses to be an intensely competitive sport with a handful of winners and many graveyard relics.

“Rojifi’s play is ambitious and interesting, and it will be exciting to see the team make good on their AI-first promise,” he said.

Infrastructure for a Trillion-Dollar Market

Rojifi isn’t just a payment app; it is a B2B infrastructure play. It is a fully licensed Money Service Business in Canada and is aggressively pursuing International Money Transfer Operator (IMTO) licenses in Nigeria. This dual-regulatory strategy signals to the world that Rojifi speaks the language of global compliance.

The platform supports payments to over 200 countries, handling USD, EUR, GBP, and CNY. It offers high-liquidity rails designed to withstand the volatile FX swings that often plague African markets. Crucially, it allows businesses to onboard using their existing local entities democratising access for those who don’t have the resources to set up offshore LLCs.

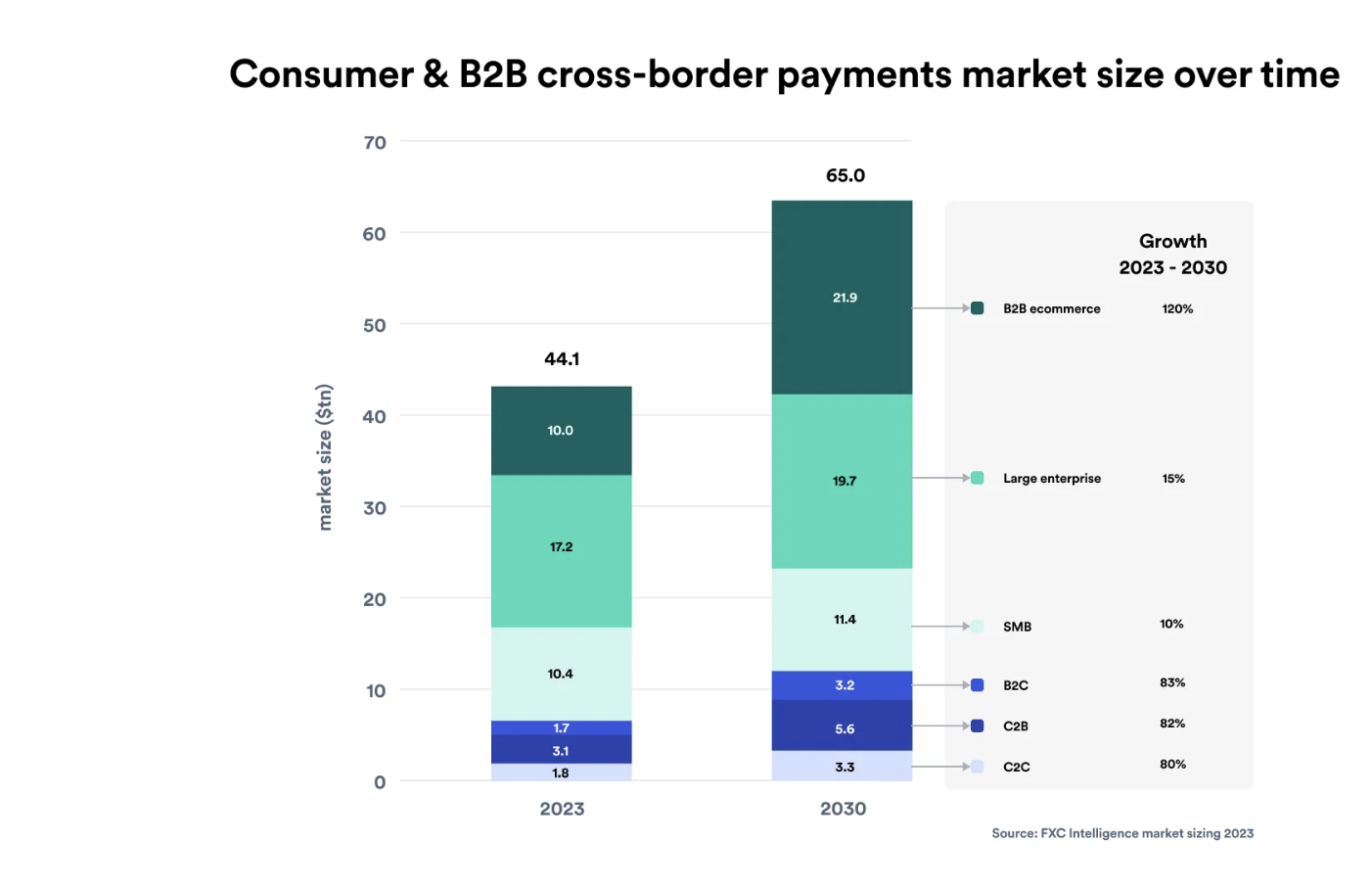

This focus mirrors a massive market shift; while consumer remittances once dominated the narrative, the African cross-border B2B market is valued at $329 billion today and is projected to explode to $1 trillion by 2035.

Rojifi is betting on a simple premise, which is that Africa’s challenge isn’t a lack of ambition, but it’s a lack of infrastructure. By dismantling decades-old barriers, the company isn’t just moving money, but it is redefining how African commerce shows up globally.