In this StanfordMarkets.com review, readers will discover how the platform offers access to a broad range of global markets. For those looking to invest across multiple stock exchanges and diversify with forex, commodities, indices, and cryptocurrencies, StanfordMarkets.com review reveals a platform built for global trading. With a user-friendly interface and options for traders of all experience levels, it’s positioned as a versatile choice for investors eager to explore the world markets.

Stanford Markets emphasizes accessibility, providing tools to seamlessly trade on major global exchanges, with resources designed to support a smooth trading experience. Whether one is a novice or experienced trader, the platform offers advanced tools and multiple account options to align with individual goals. This review examines key features, including its market range, account tiers, and support resources, to help traders evaluate if Stanford Markets meets their needs for international market exposure.

Trading Beyond Borders: Accessing Global Markets with Ease

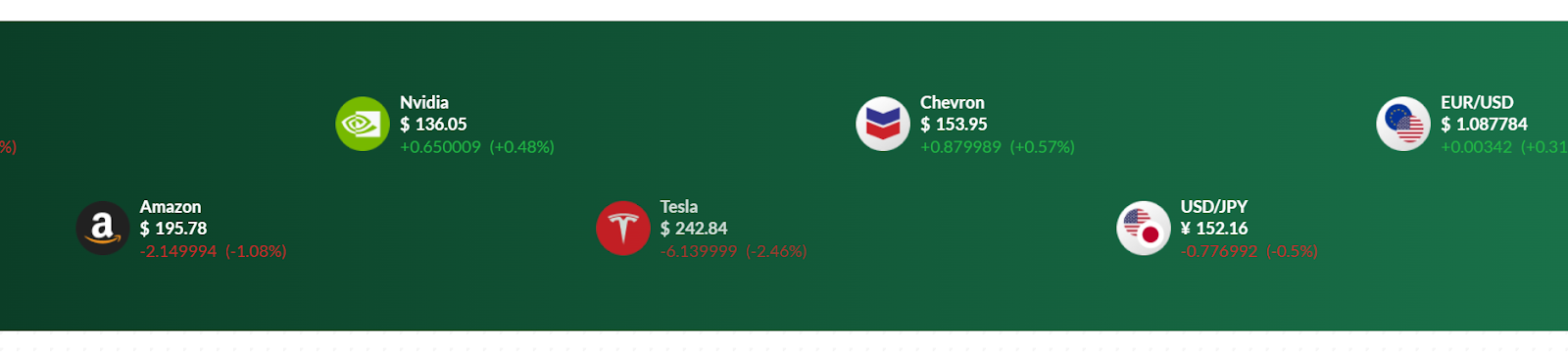

Trading in international markets offers investors the opportunity to diversify portfolios and tap into growth sectors across the globe. The Stanford Markets platform gives traders access to major exchanges around the world, allowing them to buy and sell stocks, currencies, commodities, and indices from diverse regions. This global reach is particularly beneficial for investors seeking to hedge their risks by investing in multiple currencies and industries. By opening the door to various global economies, traders can potentially leverage opportunities that might not be available in their home markets.

Accessibility to global markets can significantly broaden trading possibilities, but it also requires a platform that supports seamless execution across different exchanges. The Stanford Markets platform’s infrastructure is designed to handle high-volume trades, with user-friendly navigation to help traders explore these markets efficiently. Additionally, tools such as customizable charts and real-time data provide insights into market trends across different time zones. This approach to worldwide trading means that investors can make informed, timely decisions with access to up-to-date global financial information.

Why Diversifying Assets Matters for Global Traders

Offering a wide selection of Stanford Markets asset classes is a crucial part of creating a well-rounded trading experience. This platform features a variety of assets, including stocks, cryptocurrencies, forex pairs, commodities, and indices, allowing traders to diversify within and across markets. By having these options available in one place, investors can tailor their portfolios to match their unique financial objectives. Cryptocurrencies, for instance, provide high-risk, high-reward potential, while commodities offer a more stable, long-term investment.

Investing across multiple asset classes also provides a chance to learn about different market behaviors, from the high volatility of forex to the growth trends in tech stocks. Each market responds differently to economic indicators, political events, and investor sentiment, and this variety can add depth to one’s investment strategy. The availability of these assets on a single platform makes it easier for traders to study correlations, spot patterns, and manage portfolios with both flexibility and control.

Asset Classes: Stocks, Crypto, Forex, and More

Offering a wide selection of asset classes is a crucial part of creating a well-rounded trading experience. This Stanford Markets platform features a variety of assets, including stocks, cryptocurrencies, forex pairs, commodities, and indices, allowing traders to diversify within and across markets. By having these options available in one place, investors can tailor their portfolios to match their unique financial objectives. Cryptocurrencies, for instance, provide high-risk, high-reward potential, while commodities offer a more stable, long-term investment.

Investing across multiple asset classes also provides a chance to learn about different market behaviors, from the high volatility of forex to the growth trends in tech stocks. Each market responds differently to economic indicators, political events, and investor sentiment, and this variety can add depth to one’s investment strategy. The availability of these assets on a single platform makes it easier for traders to study correlations, spot patterns, and manage portfolios with both flexibility and control.

Account Types That Cater to Every Investor’s Needs

Stanford Marketsm offers various account types designed to suit traders at different experience levels and with varying financial goals. For beginners, there are accounts that feature educational resources and simplified tools to help them get started. For more experienced traders, there are premium accounts with added benefits like lower spreads, advanced analysis tools, and higher leverage options. This tiered account structure helps ensure that each trader can find a setup that matches their comfort level and trading style.

Advanced account types also come with dedicated support and access to specialized trading tools. For instance, Stanford Markets VIP accounts may offer priority customer service, exclusive market insights, and personalized account management. These features are ideal for high-volume traders who require faster execution and deeper insights. By offering a range of account options, the platform provides a versatile experience that aligns with the goals and skill levels of individual traders, enhancing their potential for success.

Tools and Resources to Maximize Your Global Trading Potential

Successful trading requires more than just market access; it relies on having the right tools and resources. The Stanford Markets platform provides an extensive suite of advanced trading tools, including customizable charts, technical indicators, and real-time market analysis. These tools are essential for identifying trends and making timely decisions, especially when trading across multiple global markets. Customizable charts allow traders to track specific metrics, while real-time analysis helps them respond to sudden market changes with precision.

Educational resources are also available to guide traders through various strategies, including forex, stock trading, and crypto investments. This combination of Stanford Markets tools and resources equips traders with knowledge and insights, empowering them to trade more confidently and effectively. For those looking to optimize their global trading, these features offer valuable support, turning complex market data into actionable insights that can drive more informed trading decisions.

Conclusion of the StanfordMarkets.com Review

In summary, the StanfordMarkets.com review of account types and security features highlights a platform dedicated to accommodating diverse trading needs while prioritizing user safety. The range of account types, from basic to exclusive VIP options, ensures that every trader, regardless of experience, finds the right fit to support their goals. This flexibility, coupled with advanced security measures, demonstrates a commitment to both convenience and protection, giving users confidence as they navigate complex markets. With low spreads and competitive pricing, the platform seeks to make trading accessible and cost-effective, further enhancing its appeal.

Ultimately, this StanfordMarkets.com review underscores the platform’s emphasis on tailoring experiences and safeguarding client investments. By offering tools designed to empower traders alongside robust protection protocols, the Stanford Markets platform strikes a balance that meets the needs of today’s active investors. This combination of flexibility, security, and affordability reflects a trader-focused approach, making it an appealing choice for a wide range of investors in the global markets.

This article is provided solely for informational purposes and should not be interpreted as a recommendation. The author disclaims any responsibility for actions taken by the company during your trading activities. The information presented may not be fully accurate or current. Your trading and financial decisions are your own responsibility, and it is essential not to rely solely on the information provided here. We do not guarantee the accuracy of the information on this platform and disclaim any liability for losses or damages incurred through trading or investing.