In July 2018, Kenya’s SokoWatch, Hover, a USSD firm founded by KopoKopo’s Ben Lyon and Rwanda’s Leaf raised funding each from BFA’s Catalyst Fund to help bring their fintech products and services to millions of users in emerging markets.

SokoWatch had the same week announced it had raised $2 million from 4DX Ventures with participation from Village Global, Lynett Capital, Golden Palm Investments, and Outlierz Ventures. 4DX Ventures has also invested into Africa’s Andela, Flutterwave, and mPharma.

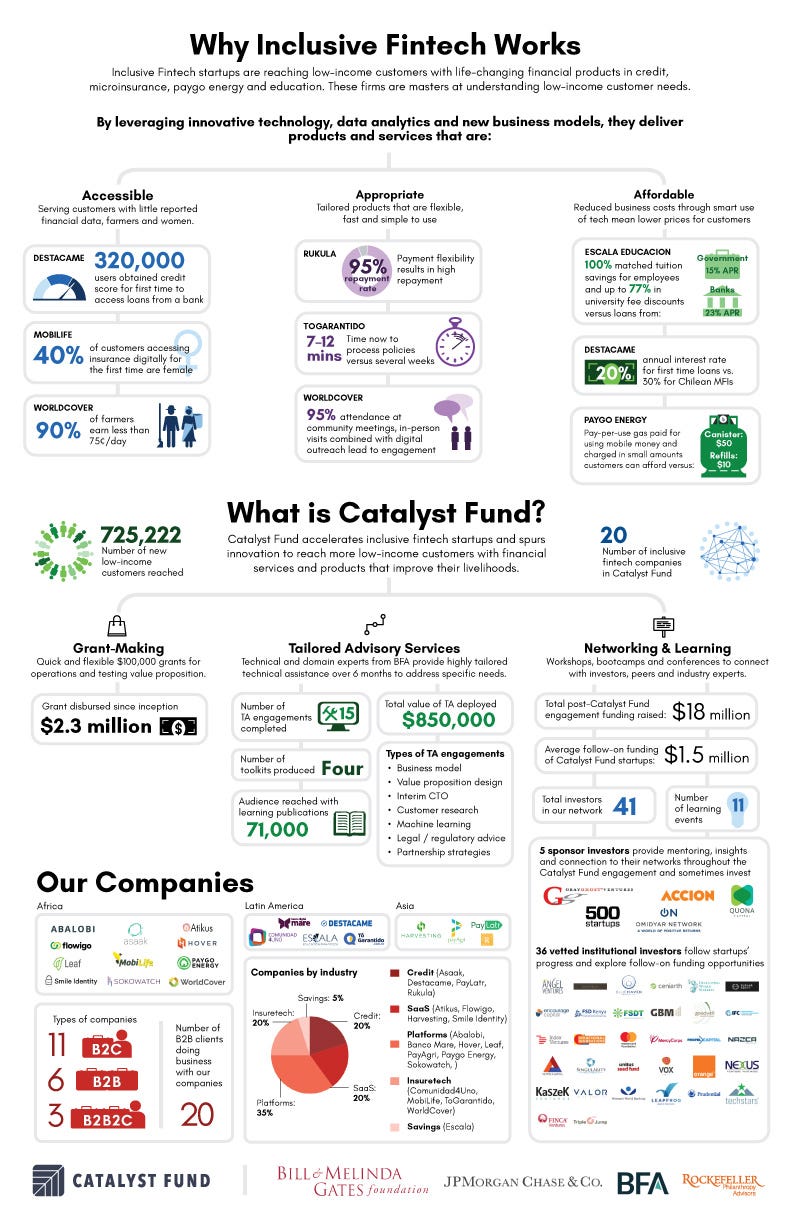

The Catalyst Fund’s 5 “inclusive fintech” early-stage funding is targeted at startups in its early 2018 cohort and its main purpose is to de-risk them. and get them investment-ready.

“The 12 companies that sought follow-on funding after completing the program secured an average of $1.5 million each,” said Catalyst Fund.

“Bank accounts and payment transfers are receiving a lot of attention and are growing in the number of subscribers, but they aren’t being used with the frequency that you’d expect,” said David del Ser, Catalyst Fund Program Director and Director of the AI Studio at BFA. “We’re accelerating inclusive fintech companies whose solutions will achieve greater usage and help address the complete financial lives of these populations — there is great need and demand for these kinds of products and services in emerging markets.”

Inclusive Fintech refers to a wider range of modern financial services, beyond bank accounts and digital transfers, that are tailored to the unmet needs of emerging market customers to ensure adoption and to enable users to move up the financial ladder.

With operations in Kenya and Tanzania, Sokowatch is an e-commerce platform offering African informal retailers on-demand and free delivery of store products and credit lines to address common stockouts, lack of access to working capital and business management tools.

The second startup to receive investment was Hover, founded by KopoKopo’s Ben Lyon. Hover is building a USSD technology to enable mobile developers to turn an existing communications protocol, USSD, into an invisible transport layer, allowing the facilitation of in-app mobile payments so that users who can’t access or afford data plans can still connect to transact.

Rwanda’s Leaf on the other hand helps refugees transfer their assets across borders safely using blockchain technology. The other companies in the July 2018 cohort include India’s PayAgri, an agri-fintech startup that aims to streamline the Indian agriculture value chain and Latam’s Banco Mare, a digital bank allowing users to pay bills, pay at merchants and make peer-to-peer transfers via the blockchain.

These five made Catalyst Fund’s cohort to reach 20 startups targeted at transforming lives of populations in Africa and other emerging markets. Chipper Cash and Turaco might as well go ahead to raise follow on funding after the accelerator.

“We are proud to invest in solutions that have the potential to transform the financial lives of people across the world and in technology that is reinventing the global financial services landscape,” said Janis Bowdler, President, JPMorgan Chase Foundation. “We look forward to seeing the impact that the 20 Catalyst Fund companies will make on consumers’ lives.”

Participating Catalyst Fund cohort companies must first be nominated by a sponsoring investor in order to be considered, and a pre-selected group of investors can make follow-on investments once the companies have been de-risked by completing the program. Startups receive flexible grant capital, technical assistance, mentoring and access to networks of follow-on investors.