Catalyst Fund, which invests in early-stage ventures working in the financial inclusion sector in emerging markets has selected Kenya’s Turaco and Uganda’s Chipper Cash into its latest cohort.

Kenya’s Turaco is a low-cost insurance provider targeting low-income customers with premium payments of as low as $2.

Turaco is targeting over 14.2 million people pushed into poverty due to expensive health expenses by partnering businesses to provide affordable insurance products to blue collar workers via its B2B service. te premiums are deducted automatically.

In Kenya alone, fewer than 22% of the population has insurance and the total addressable market in Africa totals roughly about 89 million Africans.

Uganda’s Chipper Cash is a free, peer-to-peer mobile money remittance service across Sub-Saharan Africa regardless of one’s mobile money provider. Chipper allows low income customers to easily transact instantly without a fee.

Launched in 2017, Chipper Cash has on-boarded over 40,000 customers in Ghana, Kenya, Tanzania, Rwanda, and Uganda.

The firms will each receive between $50,000 to $60,000 in non-equity support and six months mentorship and technical assistance to see them grow, network and generate revenue as well as connect with global VCs.

Managed by BFA, Catalyst Fund’s program was founded in 2016 with the support of the Gates Foundation and JPMorgan Chase & Co and supports fintech products and services that meet the needs of low-income customers in emerging markets.

“These four startups were accepted into our latest cohort because of their intentional focus on low-income customers, their unique value propositions that create meaningful products and services that are relevant to them, and for their deliberate use of technology to reach customers living in low-tech, low-trust, low-resource, last-mile environments,” announced Catalyst Fund.

Salutat and Diin are the two others selected for their tech-enabled communication platform for traditional financial institutions in Southeast Asia and Africa; and a savings and investment platform for Latin America.

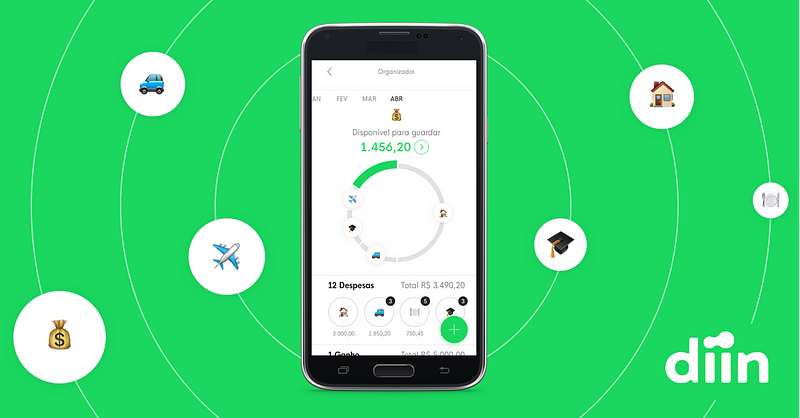

Diin is an investment platform for low-income Brazilians that incorporates customer-centric, behavioral nudges to maintain frequent contact with its users. Specifically, Diin helps users set savings goals, create a savings schedule, offers financial management tips, and invests clients’ savings in public bonds and other funds to provide returns to clients.

By reducing decision-making responsibilities, Diin has created an appropriate product for first-time savers. Low-income people struggle to save money as they balance urgent expenses and low, inconsistent incomes. However, Diin, is out to change this narrative to build a strong savings culture among the middle and low-income population in Brazil, starting in Sao Paolo.

Salutat is a customized communication platform that helps traditional financial institutions improve customer-relationships and customer engagement. Salutat uses advanced technology to help traditional financial institutions better understand and connect with low-income users through a more appropriate communication tool.

As digital-lending fintech companies in emerging markets are growing and offering user-experiences that customers want, brick-and-mortar microfinance institutions (MFIs) are struggling to keep up and are losing customers. Salutat enables personalized, two-way chats with customers, and organizes chats sent via WhatsApp and Facebook Messenger into formats ready for analysis.

Salutat uses behavioral science to enhance conversations between loan officers and end-customers, reducing the need for many face-to-face interactions and phone calls. This decreases the service cost and improves service levels.