Kenya-based Badili has secured funding in a seed round led by E3 Capital, marking a milestone for the first re-commerce platform in Africa.

The investment amount, spearheaded by E3 Capital, remains undisclosed, with participation from both existing and new investors, including Renew Capital and Grenfell Holdings.

This follows Badili’s Pre-seed funding round from the previous year.

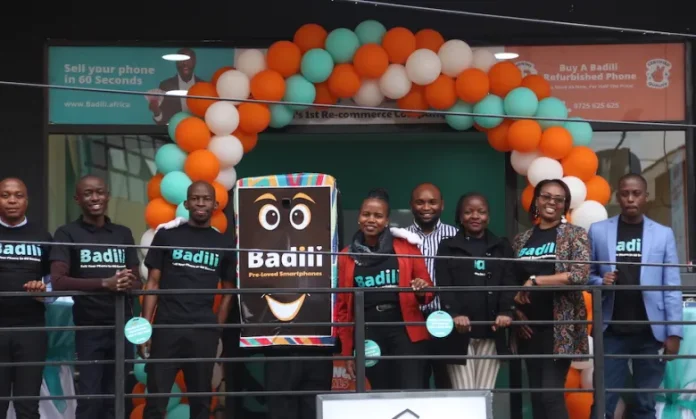

Co-founded in 2021 by Rishabh Lawania and Keshu Dubey, the firm expanded into Uganda and Tanzania last year and established a partnership with Airtel Uganda.

The company now offers refurbished smartphones through various channels, aiming to provide affordable and carbon-neutral consumer electronics.

Chief Executive Officer (CEO) of Badili, Rishabh Lawania expressed pride in having E3 Capital as the lead investor, emphasizing the potential positive impact on their business and the lives of African consumers.

The recently secured funding will enable Badili to enhance operational efficiency, expand in current markets, and recruit new talent to scale operations and stabilize unit economics.

On his Paras Patel, Managing Partner at E3 Capital, highlighted the environmental sustainability aspect of Badili’s business model, emphasizing the significant reduction in CO2eq emissions achieved through refurbished phones.

E3 Capital, previously known as Energy Access Ventures, specializes in investments ranging from $250K to $10M in companies with digitized, decentralized, and decarbonized business models.

The firm, which invested in three African companies last year, launched the E3 Low Carbon Economy Fund I in partnership with Cygnum Capital after successfully deploying its EAV-Fund I.

The three African companies that benefitted were Nuru, Mawingu and Untapped Global.

The latest funding round reinforces Badili’s position in the industry and supports its mission of promoting digital innovation and environmental sustainability in Africa.