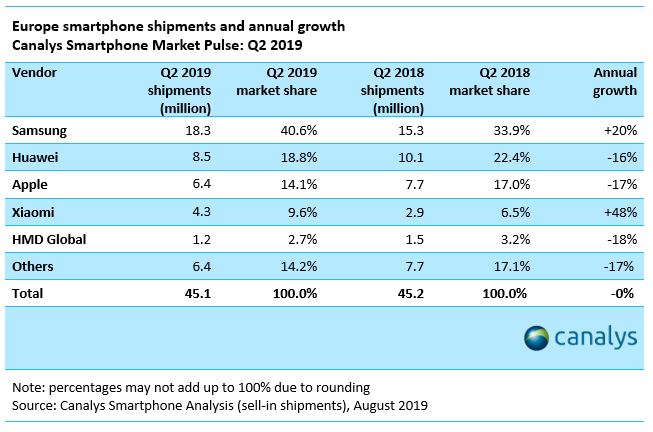

Samsung rocketed to over a 40% market share in Europe in Q2, its highest for five years, as it shipped 18.3 million smartphones., according to a new report from research firm Canalys.

Samsung shipped over 12 million A series units and it shipped more A Series units than any other vendor in Europe managed with their entire range of smartphones.

Samsung Galaxy A Series which include the Galaxy A10, A20e, A40 and A50, have been launched in various markets globally.

Galaxy A Series

“Samsung obviously had enough of losing share in Europe,” said Canalys Senior Analyst Ben Stanton. “For years, a focus on operating profit has stifled its product strategy. But this year, the shackles are off, and winning back market share is its clear priority. But its success is not solely due to product strategy.”

Samsung’s shipments grew as its main rival Huawei suffered the impact of political restrictions in the United States, which saw its shipments fall 16% to 8.5 million units. While in Europe, Apple remained the third largest vendor, falling 17% to ship 6.4 million iPhones.

On the other hand, Xiaomi took advantage to gain further share in markets where it is strong, growing 48% to 4.3 million units while HMD Global completed the top five, down 18% to ship 1.2 million smartphones.

Samsung capitalized on Huawei’s US problems

According to Stanton. “Samsung has been quick to capitalize on Huawei’s US Entity List problems, working behind the scenes to position itself as a stable alternative in conversations with important retailers and operators.”

The analysts also added that a lack of brand loyalty among users of low-end and mid-range Android smartphones in Europe was a catalyst as Europe is one of the most brand-volatile smartphone markets in the world.

Xiaomi is now a major force in Europe

“Xiaomi is now a major force in Europe,” said Canalys Analyst Mo Jia. “Its core strength remains price-sensitive countries across Europe, in online and open market channels, but it is increasingly being trusted and ranged by important mobile operators.”

With a weakened Huawei, distributors, retailers and mobile operators are actively seeking alternative brands to fill the gap and reduce their dependence on Samsung which has become a force in Europe after the fall of Huawei.

Retailers are therefore turn to alternatives such as Xiaomi which has become attractive due to its early foray into 5G.