Kenyan businesses are navigating a complex landscape fraught with challenges, from securing working capital and sourcing quality products to accessing lucrative markets.

Stanbic Bank emerges as a crucial facilitator in this environment, bridging the gap between Kenyan enterprises and their Chinese counterparts and mitigating business risks through supplier verification, capital solutions, and transactions to enable businesses to buy and sell seamlessly.

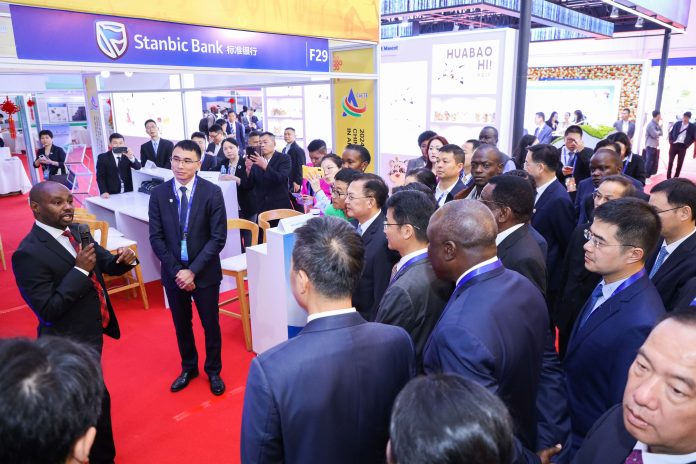

Paul Mungai, Head of Trade and Africa China Banking at Stanbic Bank, emphasised the bank’s pivotal role in mitigating risks and facilitating seamless transactions during the China Africa Economic Trade Exhibition (CAETE) at the Edge Convention Center in Nairobi.

“With over 1.4 billion people, China plays a critical role for Kenyan businesses in offering a wide market for local export produce. Stanbic Bank offers access to the China market through solutions that catalyse growth, mitigate risks, and meet product and market demand,” said Paul Mungai, Head of Trade and Africa China Banking, Stanbic Bank.

Through these rigorous supplier verification processes and tailored capital solutions, Stanbic Bank empowers businesses to navigate the complexities of international trade, particularly in the dynamic Africa-China economic corridor.

As a key partner with the Industrial Commercial Bank of China, Stanbic Bank is streamlining product sourcing, supplier connections, and logistics. This means Kenyan businesses are able to procure quality goods and establish solid business linkages, which are essential for fostering growth within the African-China economic sphere. Thus, Kenyan enterprises are poised to thrive in the competitive global marketplace.