Safaricom has established the Ziidi Money Market Fund, as a Collective Investment Scheme (CIS) accessible through its M-PESA platform, making it convenient for subscribers to grow wealth through the capital markets.

Safaricom is working with three fund managers; Standard Investment Bank, ALA Capital Limited, and Sanlam Investments East Africa Limited to offer the Ziidi Money Market Fund according to the Capital markets Authority (CMA).

Ziidi Money Market Fund is fully approved Kenya’s CMA will enable Safaricom to enhance its footprint in the finance services sector after its partnership on Mali Market Fund fell through according to people familiar with the matter. Ziidi Money Market Fund is expected to empower unit holders by offering accessible and diversified investment options as part of the broader National Government’s financial inclusion strategy.

In 2019, Safaricom announced the launch of Mali in partnership with Genghis Capital to allow registered MPesa users to invest as low as Ksh100 up to a maximum of Ksh70,000 and will attract an annual interest of 10 per cent from the comfort of their mobile phones. Mali’s fee structure includes a 2% annual fund manager fee, 0.2% trustee fee, 0.15% custodian fee and a 15% withholding tax on interest earned. The service launched to the public on December 31st, 2019 as a stand-alone fund by both Safaricom and Genghis Capital. Ghenghis Capital is operated by Overtime Capital Limited, an arm of Pamoja Capital Limited.

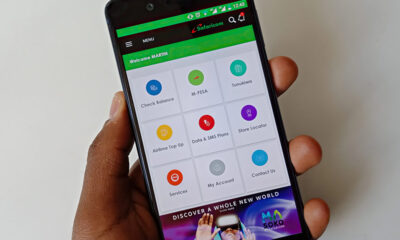

Mali users access it via the USSD code *230# and on the my Safaricom APP to support instant withdrawals. For customers who wish to take overdrafts, the payment rolls over days until the full investment pays off. On the application withdrawals and deposits are absolutely free with a 15 per cent withholding tax charged on the investment income.

By December 2023, Mali‘s asset base hit Sh1.4 billion and contributed Ksh104.5 million to Genghis Capital’s income through interest earnings. Mali’s investment portfolio had fixed deposit accounts, totaling Ksh885.4 million plus government securities, short-term deposits, and corporate bonds.