Can Konga pay facilitate the initiation and completion of transactions in a seamless manner?

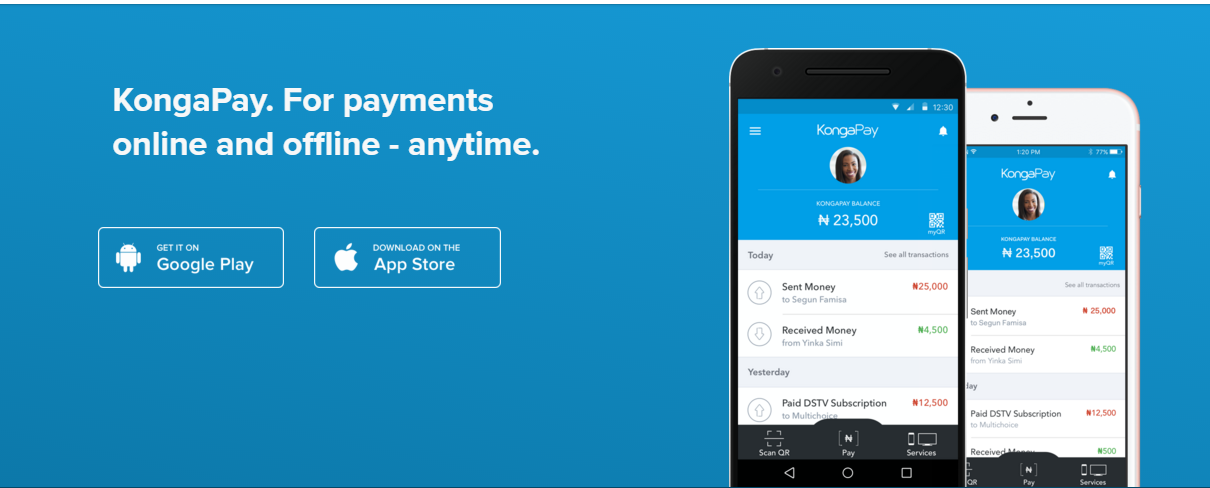

Earlier in the week, we attended an event at the Civic center in lagos hosted by Nigeria’s Largest online Marketplace, Konga.com. At the event, Konga launched what many have touted as their root to profitability, a payments product called KongaPay which they have now opened up to serve “any” business in Nigeria.

KongaPay was first launched last year on the Konga platform and went through an extensive stress test during their yearly sale, Yakata which according to Founder and former CEO, Sim Shagaya saw it record a higher volume of transactions than other payment gateways on the platform.

Extremely exciting news for Sim and the team as they took giant strides on the journey to being the Alibaba of Africa; still some way to go as Alibaba has consumer-to-consumer, business-to-consumer and business-to-business sales services via web portals, electronic payment services, a shopping search engine and data-centric cloud computing services 🙂 .

New CEO, Shola Adekoya seems to be running with the same vision the founder had and is looking like a very interesting CEO already(We hope to get an interview with him soon), he has a strong finance background(former role as CFO), so the Kongapay product should be extremely important to him.

Speaking about it, he said;

“We are extending KongaPay to other consumers outside of the Konga.com’s platform because it is designed to be fast, reliable, secure, flexible and above all provides a best-in-class financial solution to Nigerians and Africa at large.

A first in Africa and the World, KongaPay is pioneering something we’ve called me-Commerce. With KongaPay, take a photo of any item you want to sell and we’ll generate a payment QR code for you. Just like that, you will be able to share the QR code on your favorite social media sites. We’re excited to provide a unique gateway for local entrepreneurs to reach both local and international markets through social media”.

Taking a deeper look at the product, Konga have summarized the new product feature list as;

- Instant refunds

- Every phone is a POS

- Pay with just your phone number and 4-digit PIN.

- Set up payment subscriptions and recurring payments.

- Send money to any Nigerian phone number in your contacts, without asking for an account number

- Fully customizable iOS, Android and Web SDKs to enable merchants integrate and customize as necessary

- Pay offline. Just show your QR code at any participating merchant store.

- Me-Commerce – Where a user can create a shareable QR code for an item and get it out into social networks, thus enabling payments on Instagram, Facebook, Whatsapp – all through KongaPay

Extremely exciting looking at the use cases, with Konga pay, Konga may have indeed come up with a winner.

Taking a quick look at powering technology, it looks like Konga had to go through a lot of loops on the integration side to allow some of the feature sets work. Nibss central pay to help on a lot of the direct banking integrations and Zenith Bank’s MIGS for ATM card authentication for a host of others(probably what allows them to bypass 737 for direct integration with GTBank-speculation).

I personally don’t even understand all the loops, but to the customer, the most important thing is that Konga pay is a beautiful product both on the architecture and UI side. The one question that came up at the event that Associate Director, Payments and Digital Goods, JR Kanu(very funny guy) couldn’t answer was how I would use the product without an ATM card.

This may limit a number of customers from using the product, but with over 13.7 million ATM cards in circulation according to EFIna and with Banks working hard to increase the amount of ATM cards in circulation, you would say there is still a vast audience that Konga can capture.