Recently, cryptocurrency cards have become essential tools for users looking to convert their digital assets into fiat currency. These cards allow holders to spend cryptocurrency just like traditional money, which is particularly useful in regions with limited access to banking services.

In this article, we will examine five platforms offering services to exchange cryptocurrency assets into dollars. We will analyze the features of balance top-ups, cryptocurrency conversions, and the use of these cards.

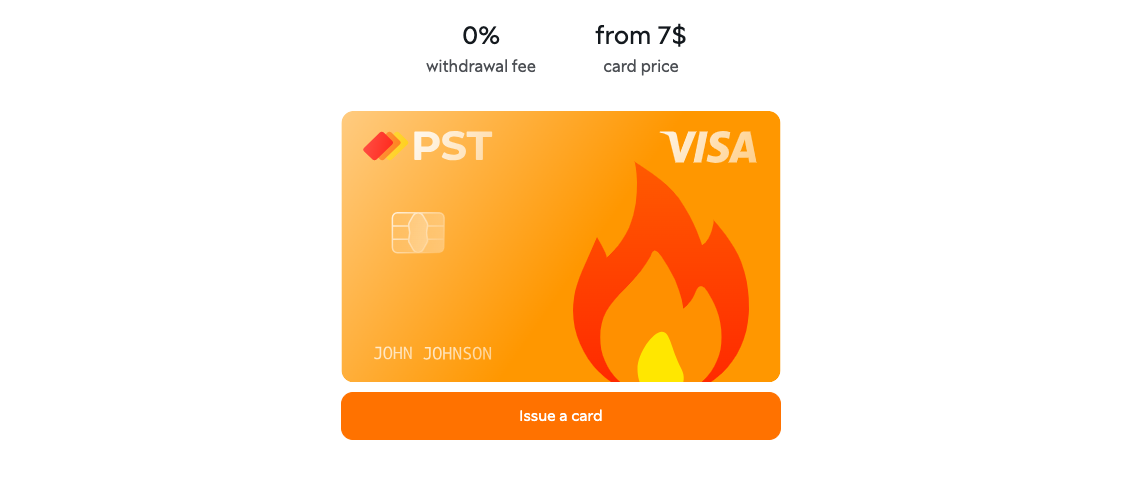

1. PSTNET

The financial platform PSTNET issues cryptocurrency cards for various purposes. Since these cards are issued by banks in Europe and the USA and operate with Visa and Mastercard payment systems, they can be used like any standard bank card.

The universal cryptocurrency card, Ultima, is suitable for all online transactions, including payments on PayPal, Spotify, Netflix, or purchases in the Google Play or Apple App Store. Spending on the card is unlimited, allowing users to spend as much as they need.

With the Crypto card online, converting cryptocurrency assets into dollars is quite simple. To do this, you need to top up the card balance with a crypto coin and then convert the required amount into dollars.

The Ultima card has no top-up limits, providing users with complete freedom in their decisions.

Balance Top-Up:

- Cryptocurrency Top-Up: The Ultima card supports top-ups with 17 cryptocurrencies: BTC, ETH, USDT (TRC 20), and others.

- Other Top-Up Methods: The card can also be topped up via SEPA/SWIFT bank transfer or other Visa/MasterCard cards.

- Top-Up Fee: A fixed 2% fee applies regardless of the top-up method.

Registration:

To get your first Ultima card, you need to register on the PSTNET platform. You can use your Google, Telegram, WhatsApp, Apple ID, or email account for this. After registration, you will immediately gain access to your user account, where you can issue the Ultima card with one click. It will be instantly available, and you can start topping up your balance and converting cryptocurrencies into dollars.

Additional Features:

- USDT Withdrawal: No commissions or fees apply.

- 3D Secure Technology: Ensures the security of card transactions.

- 24/7 User Support: You can contact support specialists through various channels.

- Positive Reviews: Users leave only positive feedback about the Ultima cards.

2. Luno

The financial platform Luno provides virtual and physical debit cards in partnership with the popular service PaySend. These cards allow users to easily convert cryptocurrency into fiat money and use it for in-store and online purchases. Luno’s cryptocurrency cards operate with the Visa payment system.

To convert crypto coins to dollars, users first transfer their crypto assets to their Luno wallet. Then, they can go to the exchange section on the platform, select the amount of cryptocurrency to sell, and place a sell order. Once the order is fulfilled, the equivalent amount in dollars is credited to their fiat wallet on Luno.

Balance Top-Up:

- Cryptocurrencies Supported: BTC, ETH, LTC, XRP, and USDC.

- Other Top-Up Methods: Users can fund their accounts via bank transfer and other payment methods.

Registration Process:

The registration process involves creating an account on the Luno platform, followed by identity verification by providing documents that confirm identity and address. This process can be completed through the Luno app or online and usually takes from a few minutes to several days.

Additional Features:

- Transaction Security: Luno prioritizes security by implementing measures such as AML (Anti-Money Laundering) and KYC (Know Your Customer) protocols.

- User Support: Available through multiple channels, including a dedicated section on the website and app.

3. YellowCard

Yellow Card is a fintech platform that allows its users to buy, sell, and send cryptocurrencies. The service can also be used for cross-border payments using stablecoins (e.g., USDT) in 20 African countries. The service operates without traditional banking support, so it can only be used for cryptocurrency management and sending/receiving payments. All transactions are conducted exclusively with stablecoins.

To convert cryptocurrency into dollars, you need to select the option to sell cryptocurrency in your personal account. Then, you can enter the amount of cryptocurrency you want to sell and choose dollars as the withdrawal currency. After confirming the transaction, the dollar amount will be credited to your account.

Balance Top-Up:

- Cryptocurrencies Supported: BTC, ETH, USDT, USDC.

- Other Top-Up Methods: Bank transfers and mobile money.

- Top-Up Fee: Minimal fees, with detailed rates depending on the specific cryptocurrency and top-up method.

Registration Process:

You can register using the website or mobile app. To start using the platform, you need to verify your data by providing documents that confirm your identity.

Additional Features:

- Transaction Security: Modern encryption methods protect users’ personal data and financial transactions. This includes password protection, secure data transfer protocols, and regular system updates to prevent attacks and data leaks.

- User Support: Round-the-clock support via the website and mobile app.

4. Busha

Busha is a platform for various cryptocurrency operations, such as storage and receiving money transfers. Busha plans to launch cards (Mastercard) for using cryptocurrency in everyday online transactions. The Busha card is a virtual USD debit card funded from cryptocurrency assets.

Busha users can sell their cryptocurrency assets for local currency (e.g., Nigerian Naira). To do this, you need to select the corresponding asset in your wallet and specify the amount to sell. To convert cryptocurrency into dollars, you need to choose the option to sell cryptocurrency for US dollars.

The top-up limit for the card is up to $5,000 per transaction, with no spending restrictions.

Balance Top-Up:

- Cryptocurrencies Supported: BTC, ETH, LTC, USDC, and others.

- Other Top-Up Methods: Bank transfers and mobile money.

Registration Process:

To register, you need to create an account on Busha and go through the KYC (Know Your Customer) process. After this, you can access the platform’s services.

Additional Features:

- Security: High level of security ensured through KYC support.

- Transaction Tracking: Users can see their transactions in real-time.

- 24/7 User Support: Available through the app.

5. Volet

The Volet platform issues virtual and physical cards. Volet Global cards operate in several African countries, including South Africa and Nigeria. These cards are supported by Visa, Mastercard, and Union Pay payment systems, so they can be used for any transactions worldwide. Notably, the Volet Global card is only available in plastic form. Activation of the virtual card is impossible without its physical counterpart.

The spending and top-up limits for Global cards are quite high: $10,000 per day.

The Volet Global card integrates with the Volet Crypto Wallet. Cryptocurrency to fiat conversions happen through the wallet. To convert crypto coins into dollars, you need to top up your Volet wallet with cryptocurrency and then transfer the required dollar amount to your Volet Global card.

Balance Top-Up:

- Cryptocurrencies Supported: BTC, ETH, LTC, and others.

- Other Top-Up Methods: Bank transfer and top-up from other Visa/Mastercard/UnionPay cards.

Registration Process:

The registration and card issuance process involves creating an account on the Volet website, verifying your identity (KYC), and setting up a cryptocurrency wallet. To get your Global card, you need to pay for the issuance, confirm your real address, and phone number.

Additional Features:

- USDT Withdrawal: Volet supports USDT withdrawals with the option to convert to other traditional currencies.

- Transaction Security: Uses two-factor authentication technology.

- User Support: 24/7 support through various channels, including chat, email, and phone.

Conclusion

Cryptocurrency cards provided by platforms like PSTNET, Luno, YellowCard, Busha, and Volet offer users convenient solutions for converting digital assets into fiat money. These cards support various balance top-up methods and ensure transaction security, making them a reliable tool for using cryptocurrencies in everyday life. With these virtual crypto cards, users can easily manage their financial assets.