Safaricom, Kenya’s leading telco, is making a bold move into the insurance industry after securing a license from the Insurance Regulatory Authority (IRA) to offer insurance products. This development marks a significant step for Safaricom as it expands its portfolio beyond mobile services, and it has the potential to transform the way Kenyans access and experience insurance.

Insurance is one of Safaricom’s five new growth areas. The firm is looking to invest in Fiber, IoT, ICT, Insurance, Wealth Management to bolster its product portfolio.

Why Is This License So Important?

With the insurance license, Safaricom can now legally provide insurance products to the public either in health, motor, life, agriculture and Maritime insurance. This is no small feat—it reflects the company’s growing role in the financial services sector. For consumers, it signals a new era of convenience, innovation, and competition in the insurance market.

The insurance license follows in the footsteps of other mobile companies that have successfully ventured into financial services. Safaricom’s M-Pesa platform, which revolutionized mobile money and made financial services accessible to millions of Kenyans, serves as a great example of how mobile platforms can unlock new opportunities for consumers. Now, Safaricom aims to extend this success to the insurance industry.

What Does Safaricom Insurance Mean for Consumers?

For the average consumer, this news brings several exciting possibilities. Here’s why:

- Affordable and Accessible Insurance: Safaricom’s entry into the insurance market is expected to drive competition, which could lead to more affordable and flexible insurance options. Given the company’s track record with M-Pesa, it’s likely that the insurance products will be designed to be easy to access and use via mobile phones—something that is especially important in Kenya, where mobile phones are often the primary tool for managing finances.

- Convenience at Your Fingertips: If you’re already using Safaricom services, adding insurance to the list of things you can manage on your phone is a major convenience. Whether it’s health insurance, life insurance, or even vehicle coverage, you could soon be able to purchase, pay for, and manage your policies directly through your Safaricom account, eliminating the need for complex paperwork or in-person visits.

- Innovative Insurance Products: Safaricom has always been known for its innovation, and it’s likely they will offer products tailored to the needs of everyday Kenyans. Expect user-friendly, micro-insurance products designed to be affordable for low- and middle-income earners. These could include things like daily premium options, pay-as-you-go insurance, or even specialized coverage for specific groups like farmers, small business owners, or students.

- Increased Financial Inclusion: As Safaricom proved with M-Pesa, mobile platforms can play a crucial role in increasing financial inclusion. Insurance, which has traditionally been seen as complicated and inaccessible to many, could become more attainable for a broader segment of the population through Safaricom’s reach.

Safaricom’s Growing Role in Financial Services

Safaricom’s entry into the insurance sector builds on the success of M-Pesa, which has brought banking services to millions who previously had no access. The company has already shown its ability to manage complex financial products, and now with insurance, it is diversifying its offerings to meet the evolving needs of Kenyan consumers.

This move also positions Safaricom as a leader in Kenya’s rapidly growing digital economy, where mobile money, banking, and other financial services are increasingly being offered through smartphone apps and digital platforms. Safaricom has proven itself as a trusted and innovative partner in Kenya’s financial ecosystem, and this new venture into insurance is a natural next step.

What Can Consumers Expect Next?

So, what’s next for consumers? While the full details of the insurance products are still under wraps, we can expect the launch to happen soon. Safaricom will likely start by rolling out basic insurance products, with additional coverage options introduced over time. Keep an eye on Safaricom’s official channels for more information on what types of insurance will be offered and when the services will become available.

As the launch approaches, Safaricom is likely to provide more details on how consumers can sign up, what the premiums will be, and what kinds of policies will be available.

Looking Ahead

The launch of Safaricom’s insurance products is an exciting development for Kenya’s insurance market and the wider economy. By leveraging the power of mobile technology, Safaricom is poised to make insurance more accessible, affordable, and user-friendly than ever before.

As always, it’s important to stay informed and be prepared to take advantage of these new opportunities. Whether you’re new to insurance or looking for better options, Safaricom’s entry into this space could be just the change the market needs.

Stay tuned for updates as Safaricom prepares to roll out its new insurance products—and get ready to experience a more seamless, mobile-first way to protect yourself and your loved ones.

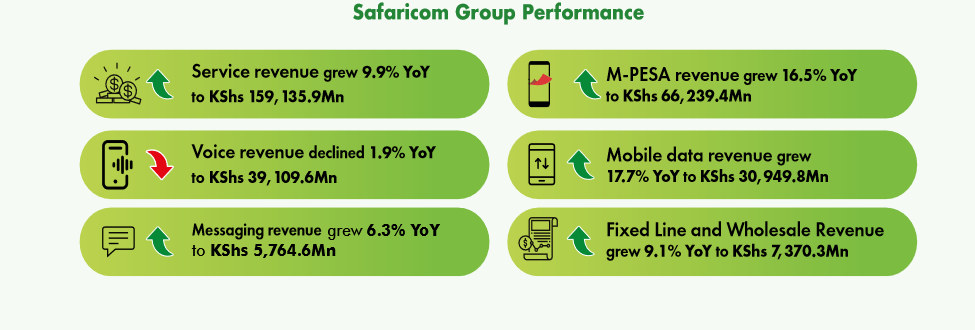

Though the firm is launching new products, Safaricom‘s mobile connectivity business which comprise of voice, data and SMS business is still the its key revenue contributor at 52.2% compared to M-PESA and other services. The connectivity business contributed 52.2% of revenue at KES 93.9 billion, while M-PESA contributed 42.9%, at KES 77.2 billion. Both the connectivity and the M-PESA business made up KES 171.1 billion or 95.1% of its revenues, meaning Safaricom has a long way to go in its transition to a TechCo and low earth orbiting (LEO) satellite service providers like Starlink have a low impact on its revenues.

The prospect of Safaricom entering the insurance market holds exciting possibilities for Kenyan consumers. By combining mobile technology with innovative financial services, Safaricom is once again setting the stage to change the game in a vital sector. With the potential to offer affordable, accessible, and convenient insurance options, this new initiative could make it easier than ever for millions of Kenyans to get the coverage they need.

Impact on Other Players Using M-Pesa for Insurance Distribution

While Safaricom’s entry into the insurance market is exciting, it also raises important questions about how it will affect other companies already using M-Pesa to distribute their insurance products. Here are a few key ways this could impact them:

1. Increased Competition

Safaricom, as the owner of M-Pesa, now becomes both a competitor and a platform provider. This could create tension for companies that currently rely on M-Pesa to distribute their insurance products. With Safaricom directly offering its own insurance products, these players may face increased competition for the attention and market share of M-Pesa users.

In the past, companies like Jubilee Insurance, Britam, and AAR Insurance have partnered with M-Pesa to offer micro-insurance products through the platform. These partnerships made it easier for users to purchase health, life, and accident insurance directly from their phones. But now that Safaricom is launching its own products, these companies might find themselves competing with Safaricom for the same customer base.

2. Dependence on Safaricom’s Platform

The fact that these other insurers rely on M-Pesa to facilitate transactions gives Safaricom significant leverage. Insurers that depend on M-Pesa for payments and distribution will need to continue working closely with Safaricom. However, the launch of Safaricom’s own insurance products could make insurers more cautious, as they might be wary of whether Safaricom could eventually create its own platform or product offerings that overlap with what they are doing.

For example, if Safaricom offers similar micro-insurance products at competitive prices, some consumers might shift to Safaricom’s offerings. While these companies can still use M-Pesa for payments, they may not be able to fully leverage the platform for marketing and customer engagement in the same way they have in the past.

3. New Opportunities for Partnerships

On the flip side, Safaricom’s entry into the insurance market might not necessarily spell doom for all players. Safaricom’s vast customer base and extensive reach could also present new partnership opportunities. Insurers may be able to partner with Safaricom to co-develop products or enhance their offerings.

For example, Safaricom could collaborate with other insurers to create joint products or offer co-branded solutions. Companies that have experience in the insurance market but lack the same reach as Safaricom could benefit from the platform’s massive distribution network, while Safaricom could rely on their expertise in creating specialized insurance products. This could result in a win-win for both sides.

4. Pressure on Innovation

As Safaricom will likely use its expertise in mobile technology and customer data to craft innovative insurance solutions, other insurers using M-Pesa will feel pressure to innovate as well. The insurance market could become more dynamic, with players forced to create better, more tailored products to compete with Safaricom’s offerings. For example, we might see new kinds of bundled services, like combining health insurance with mobile health apps, or creative pay-as-you-go policies designed for different segments of the population.

5. Potential Regulatory Scrutiny

As the number of insurers using the M-Pesa platform grows, Safaricom’s dominance in the sector could attract more attention from regulators. The government and the Insurance Regulatory Authority (IRA) may need to carefully monitor the situation to ensure fair competition. If Safaricom starts to dominate the insurance space, there could be concerns about market concentration, and regulators may step in to ensure that other insurers have a fair chance to compete.

What Should Insurers Do in Response?

For the insurers currently using M-Pesa as a platform, here are a few strategies they might consider:

- Diversify Distribution Channels: To reduce reliance on Safaricom, insurers could start exploring other mobile money platforms or even build their own direct distribution channels through apps or websites.

- Strengthen Customer Engagement: Given that Safaricom has a massive customer base, insurers will need to find ways to build stronger relationships with their existing customers, offering loyalty programs or value-added services that Safaricom may not be able to replicate.

- Focus on Niche Markets: By focusing on niche insurance products or segments that Safaricom might overlook, insurers could carve out their own space in the market. For example, providing coverage for specific groups (like SMEs or farmers) or offering more personalized services could be a way to stay competitive.

- Collaborate with Safaricom: Rather than viewing Safaricom solely as a competitor, some companies might find it beneficial to collaborate, creating co-branded products that can leverage Safaricom’s distribution strength while maintaining their own expertise in insurance.

While Safaricom’s entry into the insurance market certainly creates a new layer of competition for other insurers, it also opens up opportunities for innovation, collaboration, and growth. Insurers who are currently relying on M-Pesa for distribution will need to carefully consider how to adapt to the new landscape. Whether that means innovating, diversifying their distribution strategies, or forming new partnerships with Safaricom, they’ll need to stay agile in order to maintain their market position.

As always, the biggest winners in this scenario are the consumers, who can expect a wider range of insurance options, greater accessibility, and improved services as competition heats up. Keep an eye on the industry—it’s about to get a whole lot more interesting

Safaricom’s Agency Network: A Strong Distribution Channel for Mass Market Insurance

One of Safaricom’s biggest strengths is its extensive agent network. With over 200,000 agents spread across Kenya (many of whom are already active in facilitating M-Pesa transactions), Safaricom has the infrastructure to distribute insurance products to both urban and rural areas—reaching even the most remote parts of the country.

Here’s how Safaricom can leverage its agency network to promote insurance:

- Localized Accessibility: Safaricom agents are already trusted points of contact for many financial services in Kenya. By empowering these agents to offer insurance products, Safaricom can tap into the existing relationship customers have with these agents, which will help build trust and familiarity with new products.

- In-Person Assistance: Insurance can be a complex product to understand, especially for individuals who have never purchased it before. The personal touch offered by Safaricom’s agents—who can provide guidance, answer questions, and help customers sign up—will be critical in demystifying insurance for the masses.

- Cash Payments at Agents: Many Kenyans, particularly those in rural areas, are still more comfortable with cash payments and may not have access to bank accounts or credit cards. Safaricom’s agent network allows users to pay their insurance premiums in cash, which will be a huge benefit in bringing insurance to people who may not be able to pay through traditional banking channels.

- Micro-Insurance Distribution: Safaricom’s agents will likely be able to offer micro-insurance products, which are smaller, more affordable policies aimed at low-income earners. These policies could include things like accident insurance, health insurance, or even crop insurance for farmers—all of which could be managed directly via M-Pesa.

Safaricom M-Pesa’s Popularity: A Game-Changer for Mass Market Insurance

M-Pesa has revolutionized financial inclusion in Kenya, with millions of people using it daily for everything from transferring money to paying bills and accessing loans. By tapping into the M-Pesa ecosystem, Safaricom can use its platform to seamlessly distribute and manage insurance products. Here’s how:

- Convenience and Reach: M-Pesa has over 30 million users in Kenya, and most people have a mobile phone with access to the service. This makes M-Pesa an ideal platform for Safaricom to offer insurance products directly to the consumer’s mobile device, where they can buy, track, and manage their policies with just a few clicks. By integrating insurance into the same app people already use for other financial transactions, Safaricom lowers the barrier to entry.

- Automated Payments: With M-Pesa’s mobile money infrastructure, Safaricom can offer automatic premium payments. This could be on a daily, weekly, or monthly basis, depending on what the consumer prefers. This kind of flexible payment system makes insurance more accessible because people can pay small amounts over time instead of facing large upfront costs.

- Data-Driven Personalization: M-Pesa’s vast customer data gives Safaricom insights into users’ spending habits, preferences, and needs. This can help Safaricom develop personalized insurance products that cater to specific consumer segments. For example, if Safaricom identifies a significant number of M-Pesa users who frequently send money to their families in rural areas, they might develop a health insurance product that covers those communities specifically.

- Low-Cost Infrastructure: Since M-Pesa is already an established mobile money platform, Safaricom doesn’t need to invest heavily in new infrastructure for insurance delivery. This significantly reduces the cost of providing insurance, which could translate to lower premiums for customers—making it more affordable for the mass market.

- Financial Literacy and Awareness: Safaricom can use M-Pesa’s platform to provide educational content on insurance products, including information on how policies work, what’s covered, and how to make claims. This could be done through SMS messages, in-app notifications, or even short videos that explain the basics of insurance in simple terms, which will help overcome the knowledge gap that many people have about financial products.

Safaricom’s Ability to Make Insurance a Mass Market Product

Here’s why Safaricom is well-positioned to make insurance a mass-market product:

- Affordable and Scalable Insurance: By utilizing its massive user base and well-established distribution channels (agents and M-Pesa), Safaricom can introduce micro-insurance products with premiums as low as a few shillings per day. These small, affordable products are perfect for low-income consumers who may not have had access to traditional insurance before.

- Broad Reach: Kenya’s urban areas are relatively well-served by traditional insurers, but the vast majority of rural residents still lack access to affordable insurance products. Safaricom’s infrastructure—especially its mobile network and agent network—gives it a unique ability to reach these underserved areas, making insurance products available to people who might otherwise be excluded from the market.

- Behavioral Shift: Many Kenyans already engage in financial transactions through M-Pesa, so Safaricom has a built-in consumer base that is familiar with mobile transactions. Adding insurance to the list of services available on M-Pesa makes the product feel like a natural next step in a financial ecosystem that already includes mobile money, loans, and savings.

- Reputation and Trust: Safaricom has a solid reputation and high levels of trust among Kenyan consumers, particularly in rural areas. The company’s track record with M-Pesa and its deep connection with everyday users gives it a significant advantage in persuading people to adopt new products, including insurance.

What Can We Expect from Safaricom’s Mass Market Insurance?

- Inclusive Products: Expect to see insurance products that are low-cost, accessible, and flexible. Safaricom is likely to offer a range of policies that cater to different needs, from simple accident cover to more comprehensive health or life insurance.

- Customizable Plans: With Safaricom’s deep insights into consumer behavior, they may offer pay-as-you-go premiums or flexible coverage options, making it easier for people to select the coverage they can afford or need.

- Quick, Efficient Claims: The simplicity of the M-Pesa platform could extend to the claims process. Consumers might be able to file and track claims directly via their mobile phones, making the process faster and more transparent.

The Future of Insurance in Kenya

Safaricom’s ability to use its agency network and M-Pesa platform to distribute insurance products gives it a significant edge in making insurance a mass-market product in Kenya. By offering affordable, flexible, and easily accessible insurance options through these channels, Safaricom can reach a broader audience than traditional insurers have been able to. This move not only promises to drive financial inclusion but also has the potential to revolutionize how millions of Kenyans think about and access insurance.

As Safaricom leverages its technology, trust, and infrastructure, we can expect more Kenyans to benefit from insurance coverage—no matter where they live or how much they earn.

Winners:

1. Consumers (Especially the Underinsured)

The biggest winners in Safaricom’s entry into the insurance market will be Kenyan consumers, particularly those who have been excluded from traditional insurance options or have found them too expensive or complicated. Safaricom has a massive reach through its M-Pesa platform, which already serves millions of people who might never have considered buying insurance before.

- Affordable Products: Safaricom is likely to offer micro-insurance products with low premiums, which will make insurance more affordable and accessible to low- and middle-income Kenyans. These products could cover things like health, life, and accident insurance, providing much-needed protection to those who previously couldn’t afford it.

- Increased Financial Inclusion: Safaricom’s entry could also improve financial literacy and access to financial products. The company’s reputation for simplicity and ease-of-use will help introduce many consumers to the benefits of insurance, even in rural and remote areas.

- Convenience: Since consumers are already familiar with using M-Pesa for other financial services, they will be able to purchase, manage, and pay premiums for insurance policies via their phones, making insurance incredibly convenient and easy to use.

- More Options: With Safaricom bringing innovative insurance products to the market, consumers will have access to more choices and greater flexibility in terms of coverage, premiums, and payment plans.

2. Other Mobile Platforms/Telecoms

While Safaricom is likely to be the dominant player, other telecom companies and mobile platforms operating in Kenya—such as Airtel and Telkom Kenya—could also benefit from the trend of mobile-driven financial services, including insurance.

- New Market for Telecoms: Safaricom’s move could inspire its competitors to explore their own partnerships or products in the insurance space. This could create a broader mobile insurance ecosystem in Kenya, where other telecoms find ways to introduce competitive offerings.

3. Insurance Companies with Existing Digital Models

Some insurance companies that already have digital platforms or partnerships in place may benefit from Safaricom’s entry, as it could grow the overall market for insurance products in Kenya.

- Opportunities for Partnerships: Insurers with digital or mobile-first strategies—like Britam or Jubilee Insurance—may partner with Safaricom to leverage its network and expand their customer bases. For example, Safaricom might collaborate with these companies to offer co-branded products or to distribute insurance through the M-Pesa platform.

- Innovative Products: Insurers that are already familiar with offering micro-insurance or tech-driven insurance models might find new avenues for growth by expanding into niche markets that Safaricom’s broad consumer base represents.

4. Safaricom Itself

Safaricom stands to benefit from significant revenue generation and market expansion through its new insurance products.

- New Revenue Streams: The company will tap into a new market that could become a substantial revenue driver. Given Kenya’s underpenetrated insurance market, Safaricom has the potential to capture a significant portion of the market with affordable, mobile-first insurance options.

- Brand Loyalty and Customer Retention: By offering insurance products, Safaricom can increase customer stickiness. Consumers who already use M-Pesa for daily transactions may be more likely to stay loyal to the brand if Safaricom provides a broader suite of services, including insurance.

Losers:

1. Traditional Insurance Companies

While some insurers might benefit from partnerships with Safaricom, many traditional insurance companies will face new competition in the form of lower-priced, mobile-friendly products.

- Loss of Market Share: Established insurers like Old Mutual, UAP, AAR, and Sanlam could see a loss of market share as Safaricom’s more affordable, mobile-accessible insurance products gain traction. These companies have traditionally relied on agents, brokers, and face-to-face transactions, but Safaricom will be competing by offering insurance directly through mobile phones at a lower cost.

- Pressure on Pricing: With Safaricom offering micro-insurance products at competitive prices, traditional insurance companies may feel pressure to lower their premiums or innovate quickly to keep up, which could lead to thinner margins for them.

- Increased Competition for Customers: Insurance companies that don’t have a strong digital presence or mobile strategies may struggle to compete, as Safaricom’s reach and convenience could make traditional models feel outdated. Many customers may be drawn to the ease of signing up for insurance on their phones through M-Pesa rather than dealing with lengthy paperwork.

2. Brokers and Agents in the Traditional Insurance Space

Insurance agents and brokers who depend on in-person sales or complex paperwork could be adversely affected by Safaricom’s direct-to-consumer approach, particularly in urban areas where mobile access is widespread.

- Disintermediation: Safaricom’s entry into the insurance market could lead to disintermediation, meaning that many consumers will bypass traditional agents and brokers, opting instead to manage their policies directly via their mobile phones. This could reduce the role of agents in the insurance value chain.

- Job Losses in Traditional Channels: If Safaricom’s mobile insurance model becomes widespread, agents who rely on physical interactions, face-to-face sales, or paper-based documentation may find themselves out of work or needing to pivot to a digital-first model.

3. Small Insurers and New Entrants

Smaller insurance companies or startups looking to enter the market could struggle to compete with Safaricom, which has the dual advantage of brand recognition and a massive customer base.

- Barriers to Entry: New insurance providers, especially those without a strong mobile presence or the financial resources to compete on price, might find it difficult to enter the market now that Safaricom has a foothold. They would have to face the challenge of competing with an established brand that has already reached millions of consumers via M-Pesa.

- Potential Consolidation: In the long run, smaller or struggling insurers may face pressure to either innovate quickly or merge with larger players to stay afloat in the face of intense competition from Safaricom.

4. Traditional Distribution Channels (e.g., Banks)

Traditional distribution channels like banks, which have long been key players in distributing insurance products, might also feel the impact of Safaricom’s entry.

- Reduced Bank-Brokered Insurance Sales: Banks often rely on selling insurance through partnerships with insurance firms. As Safaricom offers easier access to insurance via M-Pesa, customers may choose to buy policies directly through their phones instead of purchasing through a bank, reducing bank-led insurance sales.

Who Will Ultimately Benefit?

In the end, consumers will undoubtedly be the biggest winners. They will gain access to affordable, convenient, and mobile-friendly insurance products that are tailored to meet their needs, especially those who previously couldn’t afford traditional insurance or were excluded from the market.

However, traditional insurance companies, brokers, and other players relying on face-to-face interactions may find themselves at a disadvantage, as Safaricom uses its extensive infrastructure and mobile technology to capture a significant share of the market. On the other hand, companies that adapt to the mobile-first model and leverage Safaricom’s platform for partnerships or co-branded products will have opportunities for growth.

Safaricom’s entry into insurance could be a game-changer, reshaping how the industry operates and creating a more inclusive, accessible insurance ecosystem for Kenyans.