- NCBA Group is a full-service banking group serving corporate, institutional, SME and consumer banking customers.

- NCBA Group operates in five countries including Kenya, Uganda, Tanzania, Rwanda, and Ivory Coast.

- NCBA Group is the largest banking group in Africa by customer numbers serving over 60 million customers.

For many years, Martha Ouma, a 42-year-old vegetable vendor (Mama Mboga) from Nyalenda in Kisumu, Kenya, struggled with cash flow.

Ms Ouma, like many small-scale traders in Kenya’s informal economy, lacked access to formal banking services. Cash flow was her biggest day-to-day struggle as she served many customers in her home area who knew her and most times wanted goods on credit.

In 2015, everything changed when she discovered M-Shwari through her M-Pesa account. The service, which allows users to get instant loans with no paperwork required but just their mobile phones, was Martha’s first ‘bank’. Martha secured her first loan of KES 2,000 to restock her inventory and diversify her product offerings.

Today, Martha manages a mini-market, credits her business growth to M-Shwari, and employs four assistants. Her story mirrors that of millions of East Africans whose lives have been transformed by NCBA’s digital products.

Martha is not the only one benefiting from digital platforms run by NCBA Group.

LOOP, another all-in-one-digital financial platform from NCBA is catering for the needs of thousands of users across the region. Allowing users to borrow, save, invest, and purchase whatever they need over its digital marketplace – LOOP Discover.

Kintu Kainerubaga, a smartphone vendor in Kigali running Kitante Communications says he uses LOOP as his digital bank and mobile money platform for his business and personal banking needs.

“LOOP is not just a bank for me,” he told TechMoran. “With LOOP I have access to digital payment services, loans both on short term and long term, buy now and pay later services and personalized financial insights and smart money management tools to help me run my business and invest in other opportunities.”

Kainerubabaga adds that Rwanda had no platforms like LOOP and the banking platforms available could only allow one to withdraw or deposit money on their accounts.

“Savings, investments and financial insights and smart money management tools are not offered by any of the traditional banks and if they are offered, one has to pay for them as separate consultancy services, and it’s expensive,” he told TechMoran.

By the end of 2024, in Kenya alone, LOOP had disbursed US Dollars more than 48 million worth of total loans since inception, processed transactions more than US Dollars 876 million for the year with over 400,000 Consumers and 160,000 Merchants registered in Kenya.

As a group, NCBA has continued to benefit from digital transformation. In its FY 2024 financial results, NCBA Group PLC has posted a profit after tax of KES 21.9 billion which is a 2.0 per cent increase compared to KES 21.5 billion reported during a similar period in 2023.

The Group also crossed the KES 1 trillion mark on digital loan disbursements due to digital transformation. The KES 1.0 trillion in digital loans is a 23 per cent increase year on year.

“We are pleased to announce our Full Year 2024 financial results which reflect the resilience of our diversified business model. The underlying trends of our P&L remained solid while our cost increase of 10 per cent was driven by targeted investments in digital transformation, network expansion and operational efficiency which have positioned us for long-term growth. Amidst ongoing external headwinds, NCBA’s strategic imperatives have enabled us to deliver shareholder value,” remarked Mr. John Gachora, NCBA Group Managing Director.

The Breakthrough that Redefined NCBA

Martha and Kintu exemplify millions of customers benefiting from NCBA’s digital transformation journey.

Launched in 2012 through a partnership between the then CBA and Safaricom, M-Shwari brings mobile banking with micro-lending to the masses over a simple, non-data enabled phone. The platform gives millions of Kenyans access to formal financial services, many of them, for the first time. To date, M-Shwari serves over 32 million users and has reportedly disbursed over $6 billion in loans, and mobilized over $400 million in deposits.

M-Shwari grew out of M-PESA which was launched 18 years ago by Safaricom, East Africa’s latest telco. M-pesa was officially launched on March 6, 2007 and in April, it had signed up over 19,671 active users and by November of the same year, it had reached 1,041,522 active M-pesa users. Today, M-PESA records over 100 million transactions daily and 4,000 transactions per second.

M-PESA empowers over 34 million customers to transact, save or borrow money through their mobile phones, M-PESA has driven financial inclusion in Kenya to 83.7% in 2021 of the adult population from a low of 26.7% in 2006 and generated over KES 139.9 billion ($1.08 billion) in revenue as at FY24.

Safaricom’s M-PESA is not the only inspiring innovation. NCBA Group is redefining Africa’s financial landscape through ground-breaking fintech innovations, empowering over 68 million customers with seamless access to credit, savings, and payments. NCBANOW, a NCBA Mobile banking solution for NCBA customers is the bank’s next leap in fintech innovation.

NCBANow

The mobile banking platform, set for launch across multiple African markets where NCBA operates or has partners, unifies NCBA’s retail and corporate banking services into a single digital experience, becoming a true bank of the future.

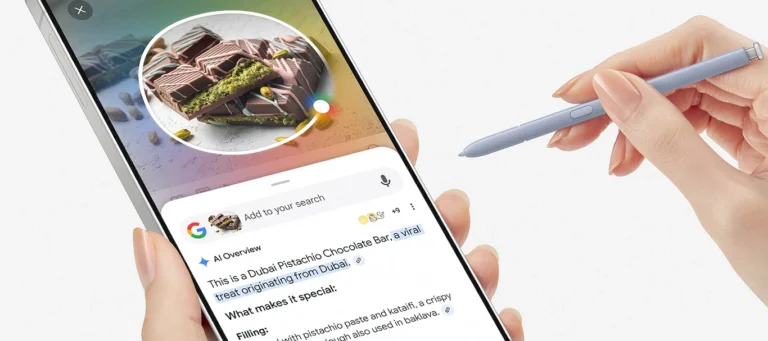

The NCBA Now App offers real-time account monitoring and card management, service requests and customizable alerts, fund transfer options, bill payments, and instant mobile wallet transactions, providing a seamless banking experience on both mobile and web.

NCBA Now is available in Kenya, Uganda, Rwanda, Tanzania and Ivory Coast, and is being expanded beyond these markets.

NCBA has expanded its fintech partnerships, targeting sectors such as merchant services (via LOOP), mobile lending, and SME financing and micro-insurance solutions integrated into digital platforms. Its recent acquisition and integration of AIG Insurance into NCBA Insurance Group is set to bring unprecedented digital disruption in the insurance sector in Kenya then across the region and Africa at large.

NCBA’s planned pan-African expansion will help it scale digital services into Southern and Western Africa and enhance product offerings with AI, blockchain, and embedded finance technologies. The firm is also strong on sustainable finance and ESG initiatives to support climate-friendly projects and socially responsible lending across the region.

From its beginnings as CBA Bank and NIC Bank, NCBA has presented itself not just as a bank but a fintech innovator shaping the digital economy and promoting financial inclusion across Africa.

NCBA Group is not just breaking down barriers within Africa—it is positioning itself to influence global fintech trends and unlock new opportunities for millions of people and businesses in the years ahead.

Building a Fintech Ecosystem Beyond Kenya

Martha’s story is one of millions across Africa, showing how M-Shwari positioned NCBA at the heart of East Africa’s fintech revolution. Beyond M-Shwari, NCBA’s mobile-first solutions that are unlocking financial access across underserved regions include one with MTN Mobile Money and Vodacom to launch MoKash, MoMoKash, and M-PAWA in Uganda, Rwanda, Ivory Coast, and Tanzania.

These platforms have impacted 29.8 million customers, disbursing over $1.19 billion in loans to date. Crucially, they address the needs of historically underserved segments—rural women, youth, and micro-entrepreneurs—empowering them to access credit, build savings, and strengthen their economic resilience.

Back home we have Fuliza and Loop driving financial inclusion even further.

LOOP and Fuliza

NCBA’s digital bank targeted at the youthful generation, LOOP serves over 400,000 consumers and 160,000 merchants, with its all-in-one digital financial services, including payments, credit, and wealth management tools.

LOOP, a lifestyle-centric digital financial platform designed to cater to tech-savvy consumers and SMEs integrates a suite of services, including Omnichannel payments (card, mobile money, QR, NFC), savings and investment tools and flexible credit offerings (overdrafts, term loans, and Buy Now, Pay Later)

Since its rollout, LOOP has disbursed over $48 million in loans and processed more than $876 million in transactions.

At Inclusive Fintech Forum 2025, LOOP CEO Eric Muriuki Eric stressed that payments should empower, not exclude people.

“For too long, financial systems have favored the few—those with the right paperwork, collateral, or proximity to a bank branch.” Muriuki said on a panel on “DPI and the Future of Payments: Building an Inclusive and Efficient Financial Ecosystem.”

But the world is changing – With solutions like LOOP, a market vendor can secure a loan in seconds, not weeks.”

Apart from LOOP, NCBA Bank also partnered Safaricom to launch Fuliza, a mobile overdraft facility, which now processes 3.5 million daily transactions and has disbursed over $22.4 billion. Fuliza plays a critical role in the day-to-day financial continuity of individuals and businesses by offering instant short-term credit. The platform is becoming an indispensable service that allows SMEs and consumers to manage cash flow gaps, emergencies, and operating expenses.

Banking experiences woven into everyday life

NCBA Bank is powering a future where banking isn’t about queues or paperwork, but an experience woven into everyday life. The bank’s vision for the future of payments is not just about new technologies but about creating systems that work, not just for the few, but for everyone. The fintech revolution isn’t in the technology and infrastructure—it’s the empowerment that comes with it.

NCBA Group’s journey began over six decades ago. It’s a result of a merger of NIC Bank, founded in 1959 and Commercial Bank of Africa (CBA), established in 1962. In 2019, the two banks merged and gave birth to NCBA Group, bringing together expertise in corporate banking experience and a trailblazing approach to digital innovation. The merger gave birth to NCBA’s new era beyond conventional banking and into Africa’s leading fintech ecosystems now serving millions of customers.