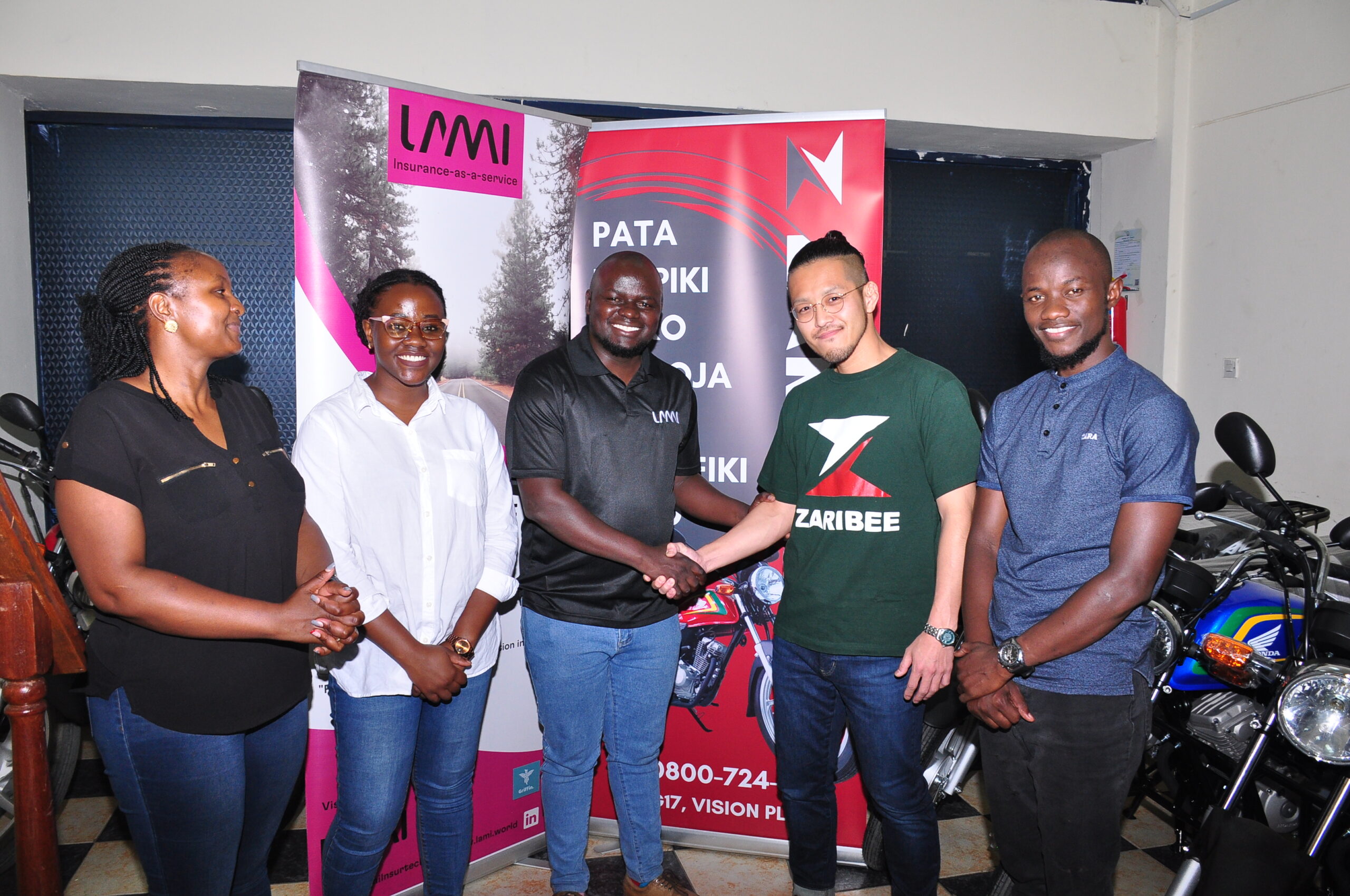

Lami Technologies is partnering with Unchorlight Kenya (UNK), to bring financial security for boda boda riders by providing them with access to suitable and reliable insurance covers.

UNK is a mobility fintech company that delivers a rent-to-own model finance service known as ZARIBEE for boda boda riders in Kenya. ZARIBEE services aim to empower riders with easier access to motorcycles by supporting them with affordable digital credit to acquire riders’ “own bikes” and accelerate the power of the country by supporting them to form a “reliable community” in which they grow together.

According to Waithera Thinguri, Head of Business Growth, Lami Technologies, “Boda boda’s are critical to Kenya’s transport system, and with the number of riders growing year by year, it is important to address the insurance gap in this sub-sector. As such, we are proud to have partnered with Unchorlight in leveraging our technology to launch reliable and suitable insurance coverage for boda boda riders, an integral part of Kenya’s economy. With thousands of people using boda boda’s daily, our digital insurance platform integrated into this solution will have a substantial and positive impact on driving inclusive growth for riders in Kenya.”

Through its partnership with Lami, a digital insurance provider, UNK will offer its riders protection with motorcycle insurance and personal accident cover, which are essential needs that enable riders to keep striving while achieving their day-to-day goals with minimal disruption to their livelihoods.

According to a report launched by Car & General in 2022, there are 1.2 million boda boda riders in Kenya, 9 out of 10 boda boda’s are used for commercial purposes, representing over 1 million jobs created, where 75 percent are youth and 6 percent women and subsequently contributing to 3.4 percent of the country’s GDP. The huge growth in the sector has been accompanied by avoidable injuries and deaths. Further data from NTSA shows that 30 percent of road traffic accidents involve boda boda’s and indicates the majority of the accidents tend to involve injury. The accidents cause the injured to rely on already overburdened families and friends to help cover the hospital bills through contributions/harambees.

Focus on the boda boda industry has primarily been on financing solutions, overlooking safety and insurance. As of 2020, the insurance penetration rate in Kenya decreased to 2.17 percent, down from 2.34 percent in the preceding year and 2 out of every 3 boda boda riders are either underinsured or uninsured. Most boda boda’s can’t afford annual premium payments for their insurance covers and the current insurance policies available include lengthy paper-based processes with claims taking up to 30 days or more. This partnership is harnessed towards bridging the insurance gap by providing affordable, efficient, and relevant insurance that will protect riders and their customers from financial losses in the case of an accident or other incidents. It will also help increase the safety and reliability of boda boda services for customers.

Renji Morita, CEO, Unchorlight Kenya said, “We are committed to growing Kenya’s boda boda sector and working with partners such as Lami Technologies to introduce digital insurance solutions that will not only promote an inclusive society but will also benefit riders and passengers – and the economy. As an emerging startup, we look forward to partnerships that enable us to grow our offerings.

Since we launched ZARIBEE, we have been working tirelessly to improve the working conditions for boda boda riders. Through this digitized insurance process, Lami has eased the entire insurance process by providing instant certificate issuance which serves the needs of our clients and aligns with objectives to transform the lives of boda boda riders across the country.”

Since its inception in 2020, Lami has improved insurance distribution by developing relevant technical platforms for insurance distribution. Through Lami’s platforms, UNK can access instant motor and personal accident insurance for its riders and credit life insurance on the motorbikes issued on Rent-to-Own basis. UNK will also be able to access products from multiple underwriters, therefore, increasing its insurance portfolio. With this partnership, riders no longer have to deal with the slow issuance of motorcycle certificates and policy documents. Additionally, this partnership has also led to reduced conflicts with law enforcement agencies as there is increased compliance.